06.12.2019, 13:00 Uhr

Chris Mahoney, Portfoliomanager, der Merian Gold & Silver Fund, Merian Global Investors, spricht im Interview über die Attraktivität von Silber und die Rolle von Gold im aktuellen Tiefzinsumfeld.

The US Federal Reserve (Fed) raises rates 25 basis points, however, overall the changes can be best described as "noise", says Mark Nash of Old Mutual Global Investors. Nick Payne takes a closer look on the consequences for emerging markets.

The Fed is in no hurry to make any dramatic changes away from its gradual pace of hikes and thats fully understandable, thinks Mark Nash, Head of Fixed Income at Old Mutual Global Investors.Since December, the outlook is marginally less positive, with the economic growth forecast less than Q4s level, amid lower consumption. Wage data fell back in February after Januarys anomalous surge, and big employment gains were offset by re-entrants to the labour market, suggesting capacity constraints werent quite as tight as expected. Finally, market pricing expectations of inflation still suggests the Fed will still undershoot its 2% target, says Mark Nash.

A relaxed Fed will support easy financial conditions, risk appetite and may hurt the US dollar in the near term. "However, it is too early to call the end to market volatility seen in 2018," state Nash. The US governments fiscal deficit is set to grow to USD 1tn on an almost permanent basis, representing a large source of spending for the US economy. According to Nash this means interest rates do not need to be quite so low to encourage borrowing in the economy as the US government is borrowing more. Therefore, the Feds long run interest rate for the US economy needs to rise, and the precise timing of this is immaterial. Interest rates will rise across the curve, and be far more meaningful than an extra hike forecasted for this year or next.

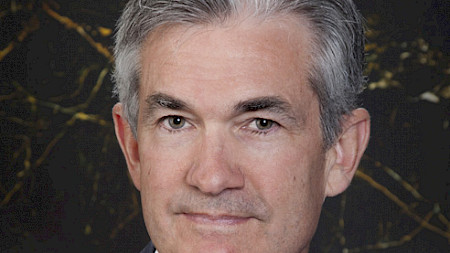

In Nash's view, Jerome Powell was able to play it safe in his first meeting without doing much. But with the US output gap closing, and fiscal policy ramping up, it is a matter of time before he will need to make tougher decisions that really might upset his boss, thinks Nash.

Emerging market equity investors should not fear the Fed

Nick Payne, Head of Global Emerging Markets at Old Mutual Global Investors was neither surprised by the rise of the Fed. It is expected to be the first of four increases this year. "Judging by the sanguine reaction of the MSCI Emerging Markets Index, emerging market equity investors are none too worried", states Payne and explains why: "If historic precedent is anything to go by, the asset class has outperformed its developed market peer group in four out of the last five rate-tightening cycles". Rather than obsess over central bank action, investors are looking, correctly so, thinks Payne, at the recovery in emerging market earnings growth and company valuations.

So far, there is little evidence to suggest that the emerging market ship will be blown off course anytime soon. Unless President Trump aggressively turns up his rhetoric on protectionism, emerging markets, for now, continue to be driven by controlled inflation on the one hand, and increased corporate profits on the other. The actions of the US Federal Reserve are all part and parcel of the normalisation of growth. "The global economy is healing emerging markets play a significant part in that," closes the expert.