23.06.2017, 16:39 Uhr

Amundi schliesst die Integration von Pioneer Investments ab und gibt sich eine neue Organisationsstruktur.

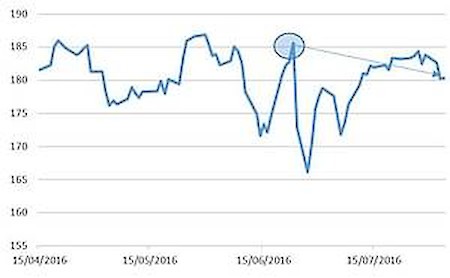

One month on and European Equity investors could be forgiven for thinking the UK Referendum never happened; the market has displayed an impressive amount of equanimity regaining nearly all lost performance. Diego Franzin, Head of Equity Europe at Pioneer Investments, explains, if investors should expect ongoing market composure or a period of consolidation is due.

Further Central Bank Easing Will Be Supportive But Not A Catalyst

The primary driver of greater risk appetite has been investors belief that central banks will release further stimulus in an attempt to offset the negative effects of Brexit. We are more sceptical than the market regarding the efficacy of Quantitative Easing (QE) on equity markets, believing that the impact will be more diluted than in previous years. It is clear that QE is important in terms of providing a supportive floor for the market. On the other hand, its more difficult to present further monetary stimulus alone as a compelling argument for the market to move sustainably higher in the face of ongoing political and economic uncertainty.

Optically Pleasing Q2 Results A Non-Event

Although good on paper Q2 earnings this year are a non-event. As most of the period in question was prior to the Referendum, these releases clearly have an inability to provide an indication of any post-Brexit deterioration. Our view is that Brexit will be a clear negative for growth across Europe. The as-yet-unknown impact on economic activity encourages us to look towards Q3 earnings releases as a better indicator for investors.

Technicals at Play Range-Bound Market Likely To Continue

Technicals rather than fundamentals have been driving the market over the last month, with the prospect of further liquidity allowing the market to move higher. On a more positive note, the market no longer expects earnings growth suggesting any resilience in Q3 numbers will be well-received. Taking everything into consideration, we retain our view that the market will remain range-bound over the remainder of 2016 until more clarity on the political and economic landscape is available. In this environment, we believe that a focus on alpha generation through quality stock selection will be a principal driver of returns.

MSCI Europe Before & After Brexit