23.06.2017, 16:39 Uhr

Amundi schliesst die Integration von Pioneer Investments ab und gibt sich eine neue Organisationsstruktur.

The long period of complacency that has characterized markets in recent times is likely to break due to unsettling dynamics revealed by the spike in volatility during September. In the view of Monica Defend, Head of Global Asset Allocation Research at Pioneer Investments, Central Banks are now experiencing a moment of truth.

The spike in volatility seen during a busy September, with meetings of the major Central Banks (CBs) taking place, reveals unsettling dynamics that could potentially break the long period of complacency that has characterized markets in recent times. In the past nine months, almost all asset classes have delivered positive returns. The slow, but steady reflation of risk assets and the slow, but steady decline in yield curves across the globe have been the result of the ongoing financial repression, which the expansionary monetary programs of Central Banks continue to nourish.

In the view of Pioneer Investments, CBs are now experiencing a moment of truth: financial markets are questioning the ability of CBs to boost output and inflation, while CBs are starting to hint that they cannot deliver stimulus forever. Hence, the forces compressing risk premiums could lessen and, just as when a long-lasting love affair starts turning sour, re-pricing may be fast and painful.

Several years after the financial crisis began, CBs continue to remain virtually the only game in town. Current unconventional monetary policies were designed for extraordinary periods of crisis management (the great financial crisis, the sovereign crisis in EU) but, with interest rates close to zero, CBs extended these programs into more ordinary times, in order to pursue their objectives (full employment and/or inflation depending on their mandate).

In September, Markets Started to Question Central Banks Action

Sources: Bloomberg, Pioneer Investments, Data as of September 15, 2016.

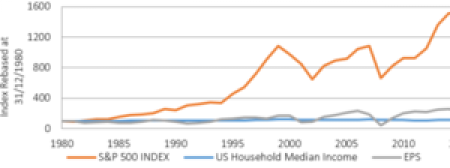

The unintended consequences of this extended period of unconventional policies is becoming a matter of concern for Pioneer Investments. Low yields and flat curves on one side and the high cost of equity capital on the other are distorting capital allocation decisions. Capital expenditures have languished, companies have preferred to utilize cash via M&A and buy backs, and the absence of investment is depressing productivity and lowering the long-term growth potential of economies. In financial markets, flows have been driven by the search for yield rather than the search for value, generating areas of asset inflation especially in the credit market. Yield curves are flatter as a result of CBs Quantitative Easing and negative interest rate policy, and banks margins are getting squeezed. Side effects are cascading through the entire economy, particularly banks, and have exacerbated the income divide. The richest share of the population has become richer, benefiting from financial asset inflation. The remuneration of labor has lagged behind the remuneration of capital. Wage growth is stalling and populist waves are emerging almost everywhere as an answer to this discontent.

Side Effects of Central Banks Prolonged QE

Sources: Bloomberg, S&P, Pioneer Investments, Data as of September 16, 2016. EPS is 12-month real earnings per share inflation adjusted, constant. S&P (current values) and R. Shiller (historic values). EPS means earnings per share.

Pioneer Investments are at a point at which CBs are asking for still more time to see the outcomes of their experimental approaches, but, according to the investment company, there is a risk that the markets patience is over. Markets are wondering if the marginal benefits of current monetary policies truly surpass the marginal costs as Central Banks continue to assert. The weakening of investors trust may be powerful enough to open the door to painful volatility.

Moreover, Pioneer Investments dont expect there will be increased policy coordination going forward. That is more a feature of truly exceptional times, when a specific event requires a fully synched up intervention. Each CB can be considered as operating according to its specific goals and utility function. The investment company believes that ECB will continue to expand its QE program due to its concerns about low inflation. The Bank of Japan (BoJ) could increase its bond purchases and go progressively negative in rates, in light of anemic growth and the absence of inflation. The Fed will prepare market participants for a hike in December if data continues to bear out the view that the US economy is strengthening materially. The Bank of England (BoE) will probably continue to over deliver, leading to the risk of cutting rates in the midst of accelerating inflation due to the pounds devaluation. Unlike the ECB and BoJ, the Fed and BoE seem reluctant to engage in negative interest rate policies.

From an investor point of view, Pioneer Investments believe its time to consider unconstrained solutions, diversifying investment approaches that allow for flexibility in a world where financial markets love for CB may start to wane.