26.07.2024, 12:33 Uhr

Die Mieten für Wohnungen sind im zweiten Quartal 2024 in fast allen Regionen der Schweiz weiter gestiegen. Bei den Büroflächen zeigt sich hingegen ein durchzogenes Bild.

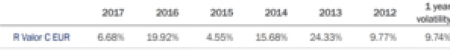

Although the first nine months of the year were marked by geopolitical tensions, Xavier de Laforcade and Yoann Ignatiew, fund managers of the R Valor fund, reassure that they nevertheless provided a buoyant environment for an acceleration in global growth.

Although the global allocation of Rothschild Asset Management's portfolio is developed on a medium term basis, the flexibility of the investment process allows the carry out of more opportunistic tactical adjustments. Between February 2016, when the funds equity exposure had reached 98%, and May 2017, the portfolios risk level was gradually reduced to 73%, in favour of a highly selective investment approach, an all-time low since 2009.

Recovering global economy

In recent months the United States, Europe and China, the three drivers of the global economy, have continued on their path of growth. Several factors highlight that, overall, a coordinated global economic recovery is underway, based on strong fundamentals and supported by the low rate environment. These include an impressive level of company results, in particular in the United States where S&P 500 earnings were up 12%, the positive surprise ratio reached 78% and companies posted a marked improvement in income for the first time in two years. Therefore the portfolios equity exposure has been gradually strengthened, focusing on sectors offering short and medium-term upside.

Changes in the euro and dollar values were also a talking point during the third quarter. The euros outperformance against all currencies was due to an acceleration in European growth and the economic cycle compensating for its earlier weak performance against other geographic areas, in particular the United States. Geopolitical tensions with North Korea and the postponed application of tax measures expected by the market have maintained downward pressure. Nevertheless, prospect of midterm elections in November 2018 is likely to accelerate an agreement over a reduction in taxes; with the Republican Party hoping to benefit from the positive impact of this emblematic reform. If successful, this measure would provide shortterm support for the greenback.

Geographic breakdown

During the past three months, geographic breakdown has remained relatively stable. The strong stance on North America, with net exposure of 40% to the United States, has been maintained. Exposure to the Canadian economy was introduced to the portfolio in 2013 and has been gradually strengthened since then. Although the Europe share of the portfolio 22% of the equity part has not seen any major changes, the weighting of China was increased slightly. Rothschild has consolidated the Chinese consumer growth theme through the purchase of Vipshop shares, which offers an attractive valuation and promising operating leverage.

Sector allocation: healthcare in the growth

Due to changes in the economic cycle the sector exposure has been adjusted. Sector rotation has been implemented aimed at strengthening the position in sectors abandoned by investors despite their growth perspectives and which had suffered tumbling valuations, such as the healthcare sector in the United States. More generally, the focus shifted towards energy, healthcare and commodities.

Exposure to healthcare-related stocks has been limited in the past. This theme, which is often overlooked by International investors, has suffered over doubts surrounding the continuation of Obamacare and pressure on drug prices. Currently a major fluid of funding towards biotechnologies can be observed, pointing to an acceleration in research in the years ahead, and in particular in cancer treatments. Therefore, investments in pharma (Pfizer, Eli Lilly) and biotechnology groups through, among others, Celgene and Gilead stocks, with the latter having also acquired the promising Kite Pharma, specialised in cancer research have been reinforced. In September, European laboratory AstraZeneca has been added to the fund, acknowledging Rothschilds convictions on the fight against cancer.

The commodities sector was also regularly strengthened in recent months. The emergence of environmental considerations has led Chinese industry to drastically slash commodity production, against a backdrop of high growth and high infrastructure spending. Driven by recent demand for the production of electric cars, the copper industry no longer enjoys capital expenditure and is becoming structurally loss-making. In light of this, the weight of Teck Resources in the portfolio has increased steadily, benefiting from the commodities price correction in May. In September, some profits following the increase in the share price during the first two months of the quarter (+44%) have been taken.

Finally, the energy theme suffered from the fall in oil prices. Several companies orientated toward US oil extraction in Texas Permian basin were added to R Valor. This region has the particular feature of being profitable despite an oil price of around $30. An investment in one of the regions main oil companies Concho Resources and in the American company US Silica, which produces sand for the consolidation of drilling wells has been made. The position in Halliburton, which develops oilfield services technologies in this region, could be strengthened.