10.03.2026, 07:26 Uhr

Der Schweizer Derivate-Spezialist Leonteq nominiert Barbara Heller und Jürg Steiger für seinen Verwaltungsrat. Dahinter steckt mehr als eine Routineangelegenheit: Das Unternehmen befindet sich mitten in einer...

150 years ago, half the European population were dead by the age of 45. Now, 50% will make it into their 80s. This sharp increase in longevity is being seen in populations all over the globe, and has a marked impact on a number of sectors and industries, which in turn results in numerous investment opportunities, comments Emma Mogford, Portfolio Manager at Newton, a boutique of BNY Mellon IM.

In Japan, the number of over 65s is predicted to increase from 27.0% of the population in 2017 to 36.4% in 2050, with similar increases being seen in the US, the UK, India, Germany, Singapore and elsewhere. In addition to the ageing population, a rise in "dependency ratio" is also being observed, with fewer working age people supporting each retiree as time goes on.

Increasing healthcare costs

One consequence that many jump to is that an ageing population increases healthcare costs, comments Emma Mogford. However, new research suggests that increased longevity might actually lower healthcare costs in many countries outside of the US. Excluding the US healthcare system, the elderly are more likely to be treated outside the hospital system and are unlikely to receive expensive, complicated treatments. Mogford refers to research that found that the increased spending at the end of life is attributable mostly to proximity to death, while studies found that the average number of bed days in hospital before death does not increase with age. This suggests that the consensus view of the impact of increasing longevity on healthcare costs may need to become more nuanced.

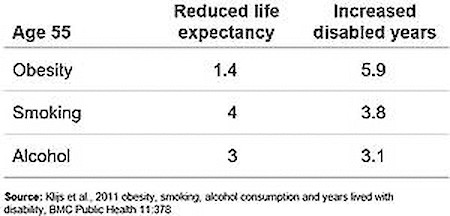

In general, it is an increase in "disabled years" that causes increased healthcare spending, rather than merely an ageing population, states Mogford. While smoking and alcohol consumption both increase disabled years, with a knock-on effect on healthcare costs, the effect of obesity on the increase in disabled years is becoming increasingly pronounced. In her view, given that obesity has doubled in the US in the last 30 years, this may become increasingly relevant.

"We can also expect both life expectancy and the quality of extra years to increase along with advancements in science and medicine. With further improvements in healthy living, disease prevention and regenerative medicine, we may see the impact of increased age on health decrease," says the expert. She continues that from an investment perspective, there is a lot of focus on "ill-health" measures, but as life expectancy increases many remain in good health for most or all of their extra time.

Retirement savings gap continues to widen

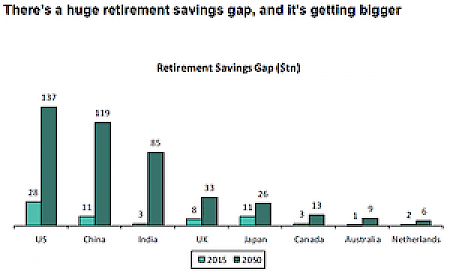

Aside from health care, many people will be affected by the increased scale of retirement savings they will need to fund extra years. There is a huge retirement savings gap, which is continuing to widen, and many people are chronically under-saving.

Retirement gap

Source: June 2018 Bernstein report Age of the aged: The implications of an older population for the financial industry

According to Mogford, this may present opportunities for pension providers and other companies tackling the issue of retirement savings and retirement planning. This extends to fintech (financial technology) firms, many of which are developing apps that make saving easier or more effective by following spending patterns or rounding up purchases and putting the extra pennies directly into a savings account.

From a consumer perspective, many current and soon-to-be retirees are clearly enjoying their leisure time, with over 65s having the fastest growing holiday expenditure and spending more on alcohol. The travel industry in particular is likely to benefit, with both package holiday and cruise operators seeing an increase in purchases from their older customers.

However, it is worth remembering, says Mogford, that many of these retirees are retiring with the backing of significant household wealth and defined benefit pension schemes. While future generations are unlikely to retire in the same financial situation, there is a trend of many retirees having high disposable income continuing for at least 5-10 years.

Influence on housing and care sectors

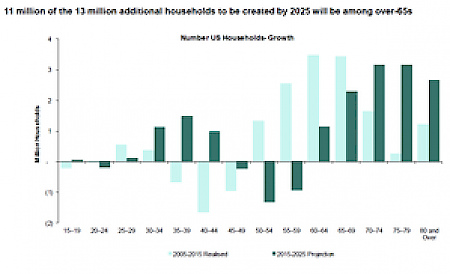

Two more sectors that are likely to be significantly influenced by this demographic trend are the housing and care sectors. 90% of US seniors plan to stay in their homes (ageing in place) indefinitely especially with the extremely high cost of living in a specific elderly care community meaning that more homes will need to be built as the population expands.